Money Musings 💭 How to consciously upgrade your lifestyle ⏫

This week: Conscious upgrade vs. lifestyle creep, another way to quell your money worries, what's on my bookshelf, and community money wins.

What you’ll find below:

Reflection: Upgrade your lifestyle in a financially savvy way

Money Move: Protect your peace to quell $$$ worries

You Gotta See This: What's on my bookshelf

Reel of the Week: Normalize money convos with friends

I talk a lot about lifestyle creep (check this reel out!), which is the unconscious increase in our spending over time. It’s the reason many of us aren’t able to save more (or at all) as we earn more money.

It’s really common and important!

But it’s also important to talk about conscious lifestyle upgrades. Lifestyle upgrades are conscious when you go through the exercise of mapping it out and understand how it will affect your budget and goals, before making the choice.

Over the years we’ve made many conscious lifestyle upgrades, especially when it comes to our kids.

Here’s an example of one I walked through before chopping off my hair.

Something I didn’t realize about shorter styles was that to keep them short, you have to get it cut more often. Sounds obvious, I know. 😆 When my stylist told me that I’d want to come in every 10 weeks (~5x per year), it was a far cry from my current 2x per year cadence. ✂️

So I did a little calculation. He charges less for short cuts.

BEFORE: $170 (including 20% tip) 2x per year = $340 per year

NOW: $135 (including 20% tip) 5x per year = $675 per year

An increase of $335 per year.

I polled you all on IG:

81% of you said to go for it 👍🏻

14% said you wouldn’t do it but I should do me

5% said it's not worth it 👎🏻

After going through this exercise I decided the lifestyle upgrade was worth it. I can make it work with my budget, I love my new style AND the time it saves me really makes up for the difference in cost many times over.

Have you made any conscious lifestyle upgrades? Hit reply. I’d love to hear about them!

P.S. If you don't have my sinking fund tool + explainer video, sign up via this form and you'll get an email with a link.

QUELL YOUR MONEY WORRIES: WEEK #4. PROTECT YOUR PEACE.

During times of uncertainty, there can be a propensity for action. We want to do something. Maybe we decide to get very informed and check the news all day. Or we get hyper focused on our finances and track the daily movements of our investments.

While I completely get the urge to be in action, focus your efforts in other places (see steps #1-3). I give you full permission not to watch your investments. Because of my work I generally know what’s going on with the market, but I’m not watching my own accounts each day. I even had the entire Money Club skip tracking their net worth this quarter. Why torture ourselves?

You can also put boundaries on news. I understand wanting to be informed (I also understand if you don’t want to lol) but put limits on it. I listen to one news podcast each day as part of my morning routine, and that’s it.

I have to tell you that J is an avid news reader and anytime he brings something up, I am familiar with what he’s talking about, so I don’t even feel like I’m giving something up.

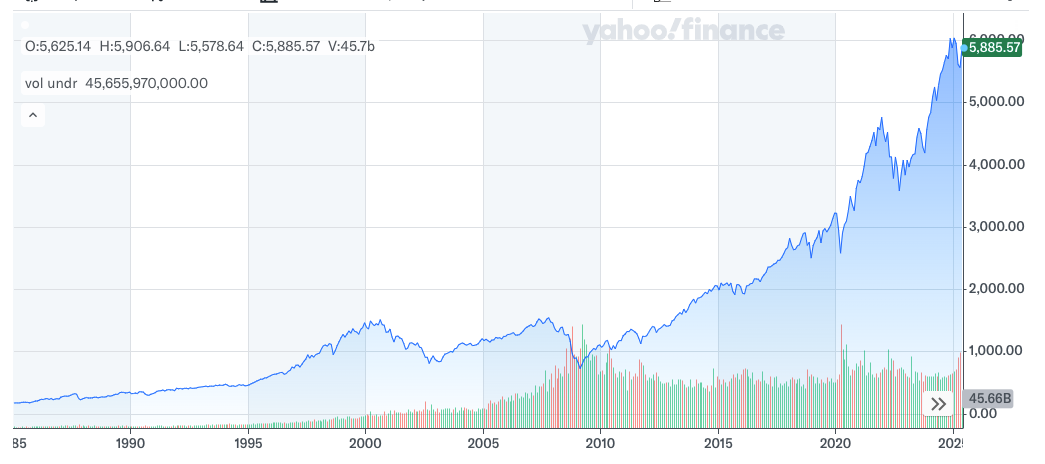

Perspective has also helped me a lot lately, specifically with the volatile market. Look at a chart of the S&P 500 (often used as a proxy for the market) over the last 30 years, 50 years, even more. What you’ll see is that there have been drops like this throughout history but that the general trajectory of the market is really strong.

WHAT I’VE BEEN READING.

Here are some of the gems I’ve been reading lately. What are you reading or excited to read? I'd love to hear!

You Have the Magic by Haley Hoffman Smith. I’m a really big fan of Haley’s work (which has helped me make major shifts in my own life). Her book walks us through her transformational methodology. It’s powerful mindset work that is a beautiful compliment to the money work we’re doing here.

101 Essays that Will Change the Way You Think by Brianna Wiest. I read another one of Brianna’s books and loved it, The Mountain Is You, and felt inspired to read another. I really enjoy picking up her book each night and reading through an essay before bed. They each give such a powerful shift (or many shifts) in perspective.

Reconnected by Carlos Whittaker. I’ve been really exploring how to change my relationship with my phone and what boundaries I can put in place to improve my overall well-being. Carlos does an extreme screen-free experiment and reports back on his experience and results. I was particularly compelled by how his memory improved drastically (one of my weaknesses).

Loving What Is by Byron Katie. I listened to this one on audio and like to come back to it to work through certain beliefs I have or annoyances that come up. It’s all about challenging our own beliefs and perspectives.

The Motherload by Sarah Hoover. I read this for my first ever book club meeting but ended up not able to make it due to an eye injury. Her honesty and vulnerability around motherhood was refreshing and inspiring, and I know it will help to destigmatize important conversations. It was also really entertaining and hilarious.

The Algebra of Wealth by Scott Galloway. I love his no nonsense and practical way of sharing personal finance, economic and career advice and often seek out his perspective.If a book has strategies that will help you build wealth, you know I’m here for it.

Here are all the amazing money moves you made this week CONGRATS! Celebrating you all!

Kristen C: I've tracked every money transaction in May so far!

Ashley R: Passed off some of the mental load to other family members this week

Becca W: 9 hr overnight ferry - didn't hesitate to pay for Wi-Fi. Only 5 euros but previously I might've reconsidered.

Becca W 2: Been spending as closely to "with abandon" as I get on this Greece trip. Tracking but no vice grip

Becca W 3: Still doing some freelance work while away (month-long trip) "unaffected" by unemployment

Shal: Paid final installment off a large loan and took on a side job to earn some extra cash!

Courtney: Started finding small remote side work to do to help tackle some lingering debts

Ariel: Cooked extra meals so didn't spend on takeout

Share your money wins here!